Brain-computer interfaces funding frontier: seventy active investors and their bets (2023)

A review of 65+ investors who made at least two investments in neurotech and brain-computer interfaces

This article was originally posted on Astrocyte (archived).

Neuralink’s fundraising success paints a rosy picture for neurotech. However, the broader landscape reveals a challenging terrain for most neurotech entrepreneurs, with investors often overlooking the sector or treading with excessive caution.

Insights from my angel investing experience point to two predominant hurdles. Firstly, there’s a palpable difficulty in integrating neurotech within the established investment themes and mandates of many funds. Secondly, the process of deep tech due diligence presents its own set of challenges.

Given that brain-computer interfaces (BCIs) often skew towards hardware, have significant ties to healthcare, and sometimes necessitate invasive procedures such as surgeries, they don’t quite fit the bill for the typical venture capital portfolio.

Meanwhile, angel investors, recognized for their versatile investment focuses, grapple with assessing opportunities in this sector. This is largely due to the niche expertise required, spanning fields from bioelectronics to specialized medical domains.

A pragmatic approach for founders would be to channel their fundraising towards funds with a demonstrated interest in neurotech. Supplementing this strategy, and fostering deeper ties with angel investors possessing relevant domain knowledge could prove invaluable.

While these connections with angels often spring from the personal networks of entrepreneurs, reaching out to relevant funds, irrespective of existing ties, can also be a strategic move.

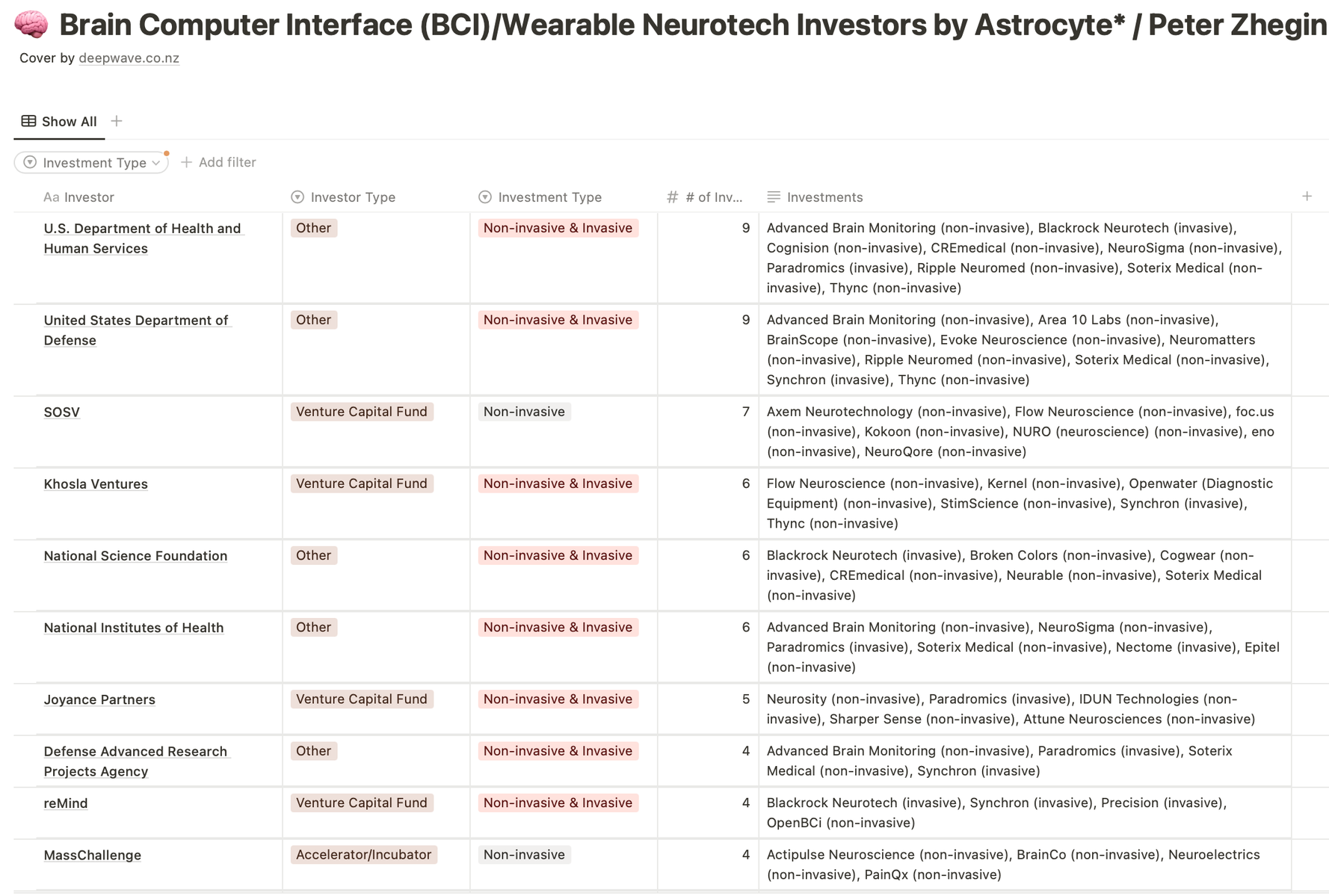

To assist founders in this endeavour, a curated directory of over 60 venture capital funds and other equity and non-equity investors with a history in BCIs has been compiled.

This includes:

- a detailed breakdown of their respective BCI investments, accessible through this Notion table,

- a handy list of fund Twitter handles.

Expect continuous refinements to the BCI investors directory. On the horizon are deeper insights into investor preferences – from funding stages to investment sizes – and an expansion to cover software-focused neurotech investors.

✍️ For periodic updates and a monthly newsletter, subscribe.

✉️ Do not hesitate to reach out to peter@approx.vc if you are a fellow investor, a founder, or a researcher interested in neurotech/BCIs.

🙏 Kudos to Ben Woodington, Dauren Toleukhanov, Ekaterina Shatalina, James Dacombe, Katherine Jones, Matt Vallin, and Nickolai Vysokov for their invaluable help curating this list.

***

👨💻Note on Data Collection

- The data is sourced from the Web and industry databases: Crunchbase, Tracxn, and Pitchbook. For any discrepancies or clarifications, ping me.

- While efforts have been made to ensure a comprehensive list, investors with limited/undisclosed deals in neurotech have been excluded. Noteworthy mentions in this context include Octopus Ventures, 7percent Ventures, Arkitect, and The Creator Fund, each having made a mark with at least one disclosed neurotech/BCI investment.