Expertise, side-hustling, and the future of venture capital

Celebrating diverse and broad angel investor base

Price went up (Yeah), angel investor (Yeah)

Price went up (Uh), angel investor (Yeah)

Kanye West

In 2019, after spending five years in venture capital I’ve started to invest in my personal capacity. Surprisingly, along the way, I’ve met not only executives and other venture capital investors who invest personally, but primarily other techies, engineers, and researchers who considered angel investing as an MBA substitute or as part of a portfolio career.

Techies investing in tech startups is creating a positive feedback loop and it reminded me of a historical anecdote. In January 1914, Henry Ford offered potential workers $5 a day for eight hours of work in a factory – more than double the average factory wage. It improved productivity, and also, according to University of California, Berkeley, labour economist Harley Shaiken, as a by-product, it helped create an industrial middle class that could afford a car and an economy that was driven by consumer demand.

The Fordian feedback loop worked through factory workers buying more cars and expanding the market. The techie investing feedback loop works through tech workers supporting emerging startups with advice and angel investing. Expertise and salaries gained at tech scale-ups channel back into the ecosystem and expand it.

This feedback loop is well-documented. The founders and early executives of PayPal are still known as the PayPal Mafia. This mini-mafia invested in >600 companies over the period from 1995 to June 2008. At a large scale, I believe this PayPal feedback loop and other less documented cases are not fully appreciated.

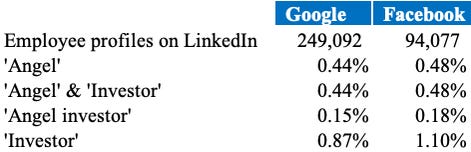

According to my quick research, and contrary to my personal experience, tech employees do not seem to be engaged in angel investing at a large scale, despite the fact that their salaries likely enable them to write small tickets (tech workers in the US earn about 61% more than the average salary). According to a LinkedIn search, somewhere between 0.5 and 1% of Google and Facebook employees identify as investors (Chart 1).

Chart 1. Tech employee LinkedIn profiles and selected keywords as of Sept 6th 2021.

Perhaps there are some factors that explain why techies are not investing actively. Building deal flow is a challenge – venture capital could clearly be considered an ‘access class,’ not an asset class. Regulation makes it harder, and transactional costs are high (e.g. investors’ legal fees are ca. $10K, if not covered by a startup).

Things are changing, however. To succeed in venture, more than access is required – nowadays ‘… a well-constructed venture program is like a good recipe that requires many ingredients, the core components of which are access and identification with a meaningful touch of allocation to your best ideas’.

Since access alone is not enough to succeed, venture capital investors are becoming increasingly interested in expertise, possibly as a way to deliver value-add to portfolio companies/differentiate in competitive deal processes and to make better allocation decisions. Inviting experts to join investment deals seems to be an obvious solution.

Arguably increased demand for business/domain expertise is also being driven by shifts in the profiles of entrepreneurs themselves with the proliferation of pre-idea/pre-seed programmes such as EF/Antler, etc. With more founders joining the ecosystem through these routes, potentially with less business experience than founder cohorts historically, more expertise is required to address blind spots.

Another kind of expertise becomes in higher demand due to the increasing popularity of deep tech. Entrepreneurs with software development backgrounds who embark on the deep tech journey need more bioinformaticians, doctors, material scientists, neuroscientists, and other domain experts. Some join the startup land full-time, while others remain in the academic/corporate realm but join startups as angel investors.

Venture capital infrastructure is also developing to allow a broader base of investors to participate. Transactional costs are decreasing thanks to Odin, SeedLegals, and others.

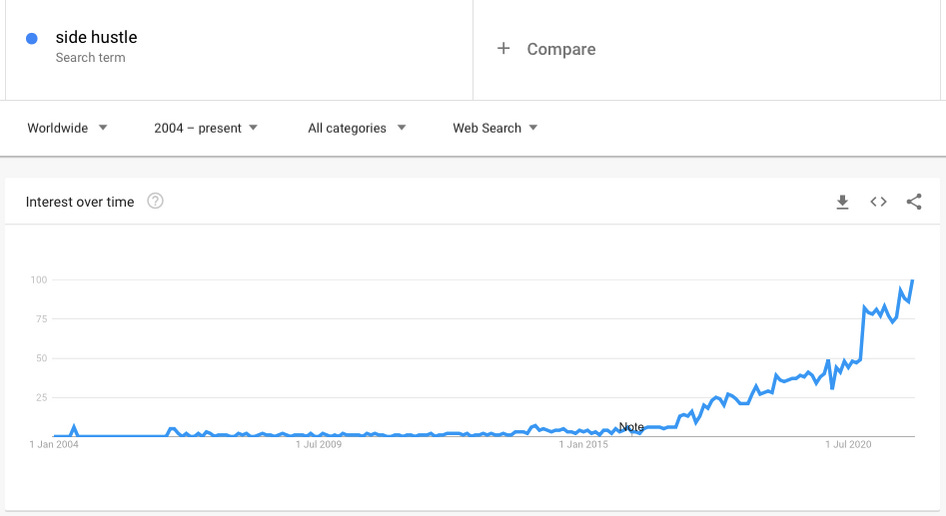

Culturally, investing is becoming the norm. Robinhood, a stock trading app, has 18M accounts, Coinbase, a cryptocurrency platform, boasts 68M users. The concept of ‘side hustle’ is clearly becoming more popular too, and the interest towards angel investing is returning to its pre 2008 level. It has even made it into Kanye West’s lyrics.

Obviously, investing in startups and investing in stocks are not the same, and the former probably requires an entrepreneurial mindset. There are signs towards wider acceptance of this mindset. Since consulting gigs are easier to find than ever before (thanks to platforms like techspert.io or upwork, and the growing demand) being a ‘diversified worker’ with multiple sources of income is becoming more popular and more people are becoming entrepreneurs in some way.

The emotional appeal of investing in startups is increasing too. As the tech sector expanded only recently, angel investing clearly became a way to support important causes and make the world a better place. Decades ago, one could hardly find investment targets that dealt with deforestation, mental health, growing inequality, or other grand challenges. Nowadays, for example, hundreds of startups work on climate challenges alone, allowing investors to invest in alignment with their values.

In addition to cultural shifts, economic incentives to invest are increasing. The incentive to diversify kicks in, since we mix full-time corporate jobs with freelancing or switch entirely to the diversified worker mode. Governments introduce tax incentives for angel investors and make the appeal to invest in startups even stronger.

Moreover, in the context where just 5% of the super-rich become richer much faster than everyone else, even relatively well-off techies may need to look at riskier asset classes to catch up.

Given venture capitalists’ and entrepreneurs’ demand for expertise, improvements of the investing infrastructure, cultural shifts, and economic incentives, I expect the angel investor base will continue its expansion. A canonical angel investor type (an ex-founder or/and an executive, investing $10-25K per deal - see here, here, here) will be supplemented by a probably more diverse profile of a side-hustling expert chipping-in with a tiny ticket appropriate to a $100K+ annual salary/income.

The venture capital industry will have to adjust to accommodate smart but small-ticketed investors. Engaging with experts for the sake of deal flow will be supplemented by their more active participation in decision-making and portfolio support.

Opportunities are already emerging here and there for those who do not fit into the standard AngelList profile, either due to less capital in hand, or/and a willingness to take a more active role in the life of an investee startup. Firm-level initiatives like Signal, Angel Squad, scouting programmes, and new formats like OnDeck’s Angels Programme or Odin’s community do precisely that, building alternative routes to angel investing.

From now on, I’d expect VC funds to pay more attention to expert/operator communities, expanding their sizes and the depth of relationships. Building a dedicated business function and improving a mostly outdated VC tech stack (a CRM centred on transactions and deals will hardly make it) is also on the agenda.

Some adjustments will happen on the entrepreneurs’ side too. For example, founders need to learn how to deal with extended captables, use tools like SPVs to aggregate tiny expert investors, get the maximum out of expert networks, and choose whom to take on board.

The automotive industry could not have happened without factory workers buying cars. I could hardly see a flourishing tech ecosystem without a diverse and broad angel investor base. I hope we’ll see more techies investing and supporting startups with their expertise, no matter what format.

🐦 >>> Follow me on Twitter.

***

Kudos to Alex Reed, Andrew J Scott, Ellen Logan, Ilya Sukhar, Patrick Ryan, and Vitaly Kazakov for reading early drafts of this note and sharing their feedback. If you find anything embarrassing on this page, it means that I did not listen to them carefully.

***

Disclosure: Peter is an early investor in Odin.