Neurotechnology landscape: beyond the healthcare market (2021)

An overview of 30 startups that work on various aspects of neurotech

This article was originally published in the Geek Culture publication on Medium, and scored 2.2K views (archived).

‘Network games, augmented reality systems, photo and video and audio tools, DJing apps, file sharing systems…, face recognizers, memory supplementers, sex apps, virtual, sober-up apps, focus apps, multi-tasking apps, sleep apps, stim apps, even digital currencies that people had adapted to run exclusively inside the brain’. Ramez Naam, ‘Apex. The Nexus Trilogy’

Science fiction writers have done an amazing job of describing how neurotech may evolve and what kind of apps we may use to augment our brains.

In this article, I explore what various neurotech applications outside the medical domain are already here. It follows my research on how ML technologies fit into neurotech, that covers mostly the healthcare segment.

This article has a rather wide view on neurotech, and covers brain-computer interfaces (BCIs, both invasive and noninvasive) and various technologies, e.g. electroencephalography (EEG), electromyography (EMG), functional near-infrared spectroscopy (fNIRS), and others. It also covers neuromodulation that partially overlaps with the BCIs space.

I look at 30 startups that work in markets other than healthcare, and align them along two dimensions (chart 1):

- Stack layer — apps vs. infrastructure & research;

- Market — various use cases, largely within three types.

The article is structured in four parts:

I. Apps

- Wellness and productivity

- Remote control

- Communication and consumer insights

II. Infrastructure and research

- Core SDKs, app development tools

- Other infrastructure

- Research

III. ‘Mother of all machine learning problems’ — data science in neurotech

IV. Analysis and discussion

***

I. Apps

There are at least three use cases for neurotech applications outside healthcare:

- The most popular use case is wellness and productivity, which is relevant to at least three types of customers:

A. general public (or/and to a specific consumer segment like athletes);

B. employers, that have corporate programs for their employees;

C. educators and/or health/wellness professionals, who may use neurotech to serve their customers better. - Another popular use case is BCIs for remote control, at least 9 startups develop BCIs to control various toys, devices, apps, and even prosthetics limbs.

- Less popular use cases are communication and consumer insights. Surprisingly very few startups build neurotech for the market that was and probably is, pivotal for the modern tech sector — social media and advertising.

Let’s explore these use cases in greater detail.

1. Wellness and productivity

Wellness and productivity neurotech apps revolve around improving various cognitive functions and usually target the general public. For instance, MyEmotiv aims to manage stress and improve the ability to concentrate. Attention and relaxation also is the focus of Neeuro and NeuroPlus. There are also apps with a more specialized approach to a certain cognitive function. Among apps mostly working with focus are Attentivmind, Mindset, BrainCo, and Humm.

At the same time a bit wider coverage of cognitive functions is common to meditation apps, powered by EEG headbands, e.g. Muse and TuSion. For instance, the latter targets concentration, relaxation, sleep, addictions, among other things.

Some startups narrow down its audiences from the general public to a segment with specific demands. BrainCo offered a series of pre-workout/post-workout exercises accompanied by EEG-enabled feedback. Pre-workout exercises increase focus, and post-workout helps to ‘… recover faster and more deeply through neurofeedback paired with guided meditation, which has been shown to reduce inflammation and cortisol levels after exercise’.

Another kind of neurotech apps is electromagnetic stimulation apps. Halooffers athletes ‘a brain stimulator that helps [to] develop muscle memory faster’. While Foc.us suggests that brain stimulation ‘…is used by different people for different purposes’, and offers devices that might be used in various ways. BrainPatch develops hardware that can ‘listen’ and ‘talk’ to your brain, and while some of their work supported by EU and UK grants is focusing on treating neurological disease, they have recently announced plans to launch a product using electrical stimulation with background music for taking control over stress.

Apps that may improve cognitive functions are offered not only directly to consumers, but also to business customers. For example, businesses may use them as a part of corporate wellness programmes. There is some evidence that using neurofeedback to shift an individual’s arousal to a state of improved performance.

Workplace wellness and productivity products developed by EMOTIV with the aim ‘… to provide easy-to-understand feedback on the level of stress and distraction to inform workplace wellness, safety, and productivity’. Interaxon, the developer of Muse headset, offers corporate wellness programmes that aim to help employees to ‘…lower stress, increase resilience and improve their engagement’. Clear corporate offers are also available from Neeuro and TuSion.

Such professionals as yoga instructors and educators are being targeted by neurotech app developers too. For example, Muse app has a professional edition that aims to help instructors to ‘…grow their practice and teach their clients meditation techniques’. FocusEDU, a product from BrainCo, promises to enable ‘…schools to bring real-time engagement metrics as well as neurofeedback-based focus and relaxation training into their classrooms’. NeeuroEDUworks on applying neurotech to education too. Its product ‘…combines brainwave technology with DIY robots to make coding fun for students’.

2. Remote control

Entrepreneurs have already started to work on fulfilling the dream of connecting the human brain to machines. One may divide remote control BCI apps in two groups, based on objects they help to control:

- enabling control over software;

- enabling control over hardware.

This section covers remote control apps for end-users. Developer tools that are required to to build these apps are covered in the ‘Infrastructure and research’ part of this article. Invasive BCIs, that among other things may have remote control capabilities are at the very early stages of development and are also covered in the ‘Infrastructure and research’ part of the article.

- BCIs for software, for instance, are developed by Myndplay and Mindaffect. Mindplay caters entertainment market and builds a ‘…video platform which allows users to control, influence, and interact with video games, apps and movies using only their mind and emotions’. Mindaffect builds an interface to allow you to control a virtual keyboard, and ‘…to spell letter by letter with your brain’.

- BCIs for hardware mostly deal with toys, at least for now. Neeuro’s SenzeBand allows basic control over robots from Makeblock mBot, micro:bit, LEGO EV3, and Arduino UNO. Spark Kids works with a proprietary crystal ball and a toy drone that respond to brain activity.

Some startups go beyond toys, and build BCIs to control more sophisticated devices. For example, BrainCo works on a prosthetic arm, and BraiQ worked on connecting humans to cars via multiple interfaces.

Unlike other startups that use EEG, BrainCo tries to connect its prosthetic arm with the brain via skin surface electromyographic signals (sEMG) ‘During training phase, users are asked to record sEMG for different gestures using the training interactive app. [these sEMG signals] are used to train a deep neural network model. […That] will be sent back to the prosthetic hand’.

Until shutting down, BraiQ was working on a platform meant to enable a car to ‘…sense the cognitive and emotional state of the passengers through in-cabin sensors (e.g. camera, EEG, heart-rate monitor). [And use it] to tailor the car’s driving behaviour to match user preferences’ .

3. Communication and consumer insights

I group these two use cases together because their combination was, and probably still is, pivotal for modern tech. Fuelled by advertisers’ desire to know more about consumers, social networks were able to get resources required to on-board billions of people and elevate connectivity to another level.

My guess is that in some way or another, the thirst of corporations to ‘…reach people in a hypodermic way’ will drive adoption of neurotech and it will become the next big thing for social platforms and messaging apps. That could be done, for example, by sponsoring headsets and integrating BCIs with consumer products (imagine that you don’t need to pull a phone out of a pocket to answer a WhatsApp message).

- At least five startups help enterprises to understand consumers better. Brainsights and MindProber are insights specialists, while Arctop, Mindplay, and BrainCo are generalists who develop insights among other products.

- However, I found only one app that merges a BCI with social network capabilities.

Brainsights develops an EEG-powered measurement platform that offers both, brands/advertisers and media/production companies insights in multiple elements of the advertising value chain. For example, the startup targets such tasks as concept development and creative effectiveness. Arctopaims to help ‘…creators strategize and execute effectively across the digital landscape by measuring precise brain metrics of content success that track to real world actions’.

MindProber uses multiple types of data (galvanic skin responses, heart rate activity or eye-tracking, and declarative data) to ‘…measure viewer’s engagement with media content and predict audience churn’. Measuring engagement also is offered by BrainCo. It uses its FocusEDU platform to allow companies to measure engagement in groups and to find ways to ‘… optimise and personalise the delivery of their content to their customers’.

MyndPlay is engaged in a wider variety of projects beyond measuring engagement. For example, a customer asked MindPlay to ‘…find out if adding dairy to everyday foods had any impact on [consumers] brains and bodies’. Another customer ordered ‘…an experiment looking into the online shopping habits of young professionals [in order] to work out whether the new generation rely more on trends than anything else for inspiration’.

On the communication/social networks side just one startup was identified. Personal Neuro Devices developed the Brainmoji app, that allowed users to create an emoji that reflected their brain state/mood. Integration with social media platforms made this emoji sharable.

Facebook announced the ‘Typing-by-brian’ project, and promised a noninvasive interface capable of decoding signals from the brain’s speech center at the rate of 100 words per minute. But then the project changed its direction.

II. Infrastructure and research

Gartner, a consultancy, defines IT infrastructure as ‘the system of hardware, software, facilities and service components that support the delivery of business systems and IT-enabled processes’. The firm includes in IT infrastructure several components, among them are application development, integration and middleware, information management software, and security software.

The infrastructural layer for neurotech is extremely thin right now, with startups unevenly distributed between its components. For example, one could hardly find a neurotech cybersecurity startup, while multiple offers of core SDKs are on the market.

It’s also difficult to distinguish between layers. Probably the boldest example of convergence between infrastructure, research, and apps layers is Elon Musk’s attempt to build Neuralink as an end-to-end product with a proprietary BCI, a surgery robot, and even a store for Neuralink-powered apps.

I see at least three types of infrastructure/research BCI startups out there:

- Core SDKs that allow developers to build neurotech-enabled apps, these are application development tools;

- Other infrastructure, like software for integration, information management, security, etc. This infrastructure may be delivered as both, tools or end-to-end product suites;

- Research startups that find new ways of connecting humans and machines.

1. Core SDKs, app development tools

The majority of startups in this bucket develop SDKs based on EEG or other non-invasive technologies, usually based on proprietary headsets/sensors. For example, NeuroSky’s developer tools package includes attention, blink detection and other algorithms. Emotiv’s SDK provides developer tools and API access to various data streams, like motion data, facial expressions data, and others.

Brainco, Neeuro, and MyndPlay also offer SDKs with features like relaxation level detection, raw EEG signals, and others. Arctop built an API that ‘…provides insights on emotional and cognitive events as they occur so systems outside the brain can respond’. The API is used by game developers and training companies to adjust their content to individual’s needs. Foc.us offers a limited Bluetooth API to developers who write apps to control brain stimulation devices from Foc.us.

Among startups that either plan to release SDKs, or have discontinued their support after realising, are Mindaffect (planning), Muse (discontinued), Personal Neuro Devices (discontinued) and CTRL-Labs (seems discontinuedafter being acquired by Facebook). Neurable seems to have experimentedwith NeuroSelect SDKs and NeuroInsight API for using EEG data for virtual reality and real-time control over software and devices, but now these attempts are likely discontinued.

2. Other infrastructure

At least four startups offer software that goes beyond core neurotech functionality, among them are:

- Blackfynn develops a platform for working with EEG, radiology, pathology and genomics data and the metadata that describes it in a secure and compliant way;

- Neuromore studio offers an extended SDK with a drag and drop interface, cloud deployment and collaboration tools;

- Personal Neuro Devices were considering in addition to SDK to develop‘… a data storage and processing system to give app developers the ability to look at mass amounts of data and discover more about a user’s mental state’;

- BrainWaveBank offers an end-to-end product suite for neuroscience research. It includes a headset, a catalogue of cognitive tests, a cloud based analytical platform, and a trial management dashboard.

3. Research

Research BCI startups focus mostly on new ways of connecting machines with the brain. Some of these startups run human trials, but they usually have neither publicly available products nor open APIs/SDKs (CTRL-Labs announced one though). However, if everything goes well, these startups may become the fundamental backbone of neurotech.

- Neuralink is probably the most well-known BCI developer. Its approach works as follows: ‘micron-scale threads are inserted into areas of the brain that control movement. Each thread contains many electrodes and connects them to an implant’. The implant then sends signals to an app, that will allow to control keyboard or mouse. There were several design iterations of the device, you could find more on them here.

Neuralink builds not only the interface itself, but works on the hole ecosystem around it, including a precision automated neurosurgery robot, an app, and at some point, a kind of applications store; - Synchron works on a BCI for neuromodulation and neuroprosthesis. It develops a minimally invasive implantable brain device implanted via the jugular vein in the motor cortex without the need for open brain surgery. This device, Stenrode, connects with the BrainPort and BrainOS to communicate with other devices and apps;

- Paradromics builds the Neural Input-Output Bus, that ‘…looks like a hairbrush with about 50,000 microwires that is modular, allowing for recording and stimulating up to 1 million neurons’. Paradromics believes that ‘… in order to enable new, effective therapies for brain-related disorders, we need to build technologies that can communicate effectively with the brain’;

- Kernel’s original technology was a memory prosthesis, while other ideas were also considered. For example ‘…needle-shaped probes with tiny electrodes etched onto their surface, … [recording] neural activity by threading tiny optical fibres through the brain’s capillaries…’.

The focus of the company right now is probably on two devices, ‘Kernel Flux, that uses magnetometers to measure tiny changes in magnetic fields and Kernel Flow, that pulses light through the skull and into the bloodstream in order to measure how much oxygen the blood is carrying at any given time’; - BIOS (formerly Cambridge Bio-Augmentation Systems) develops a ‘a full-stack neural interface platform, that uses AI to decode and encode the signals from the brain to the body, to treat chronic health conditions’. From what might be seen in the media, the company does not create a BCI itself. It rather develops ‘a neural data biomarker discovery platform’ combining long lifetime neural interfaces with an AI system to ‘learn’ the biomarkers directly from the neural data’. The tech allows to ‘… to understand and communicate with the nerves and organs directly so treatments can be made to respond to them in real time’.

III. ‘Mother of all machine learning problems’ — data science in neurotech

The ‘mother of all machine learning (ML) problems’, as some researchers call the ‘idea of being able to decode neural activity in real time and translate that into control’ provides two major scenarios of how ML can be applied in neurotech.

Among studied companies, there are examples of both, applying ML to decode neural activity, and to somehow affect it, or translate it into something. Moreover, the third scenario presents itself, where ML is applied as a tool to solve some specific research/business problems, related to the first two scenarios but not covering them entirely. Further we explore all three scenarios:

- The challenge ‘… to collect and process large amounts of neural data and then accurately interpret the neural signals, [that] are incredibly noisy, continuously changing and travel throughout the body at incredible speed’ is something BIOS is working on.

Connecting neural activity with final behaviour, understanding ‘the code of these neurones’ in real time is among core tasks of CTRL-Labs. Another startup, EMOTIV measures six different cognitive states in real time — excitement (arousal), interest (valence), stress (frustration), engagement/boredom, attention (focus) and meditation (relaxation). Using algorithms, Mindset also detects the patterns in the EEG signal that indicate a focused or distracted mental state.

Arctop, BrainPatch, Neeuro, Atentiv, Brainwavebank, and NeuroSky also provide examples of using ML to interpret neural activity. - Creating a way for the brain to control something, for example itself or an external object, is another scenario where ML comes in handy.

For example, EMOTIV ‘…. has developed a system… where the user trains the system to recognise thought patterns related to different desired outcomes, such as moving objects or making them disappear’. BrainCo’s algorithm examines ‘… over a thousand EEG features of a person in real-time… to determine brain states with unmatched accuracy. The system is used for determining a prosthesis wearer’s intent and enabling high accuracy and fast training of how to use the device’. Neurable and Mindaffect also use ML to turn signals into actionable insights providing control of connected devices, a toy, or a keyboard respectively.

Other startups apply algorithms to provide feedback to the brain. For instance, Brainpatch uses reinforcement machine learning algorithms to improve the effectiveness of the non-invasive brain stimulation. Kernel used algorithms to analyse and enhance signals produced by neurones during a memory test, then send these signals back to the brain in order to provoke memories to spark again.

Paradromics uses machine learning to provide data to the brain. Its system can harvest 30 Gigabytes of data per second, and it is expected to be ‘delivering data as medicine’ back to the brain. - Machine learning may be used to solve some specific challenges of a researcher or an app developer. For example, Interaxon collaborated with several researchers to develop new ML approaches ‘… to leverage, mine and utilise large amounts of unlabelled EEG data to efficiently discover relevant information in EEG’. Blackfynn’s analysis tools, among other things, help to dynamically identify patterns in integrated datasets to create patient cohorts and visualise disease progression over time. Mindprober uses algorithms to predict relevant KPIs of a content, such as audience ratings.

As the ML ecosystem grows, one may expect its tighter integration with neurotech. However, some challenges need to be solved to make it really happen. As one research paper notices, ‘… the fundamental problem is that the newly popular deep learning algorithms are a black box and do not provide any insights into the decision making’.

IV. Analysis and discussion

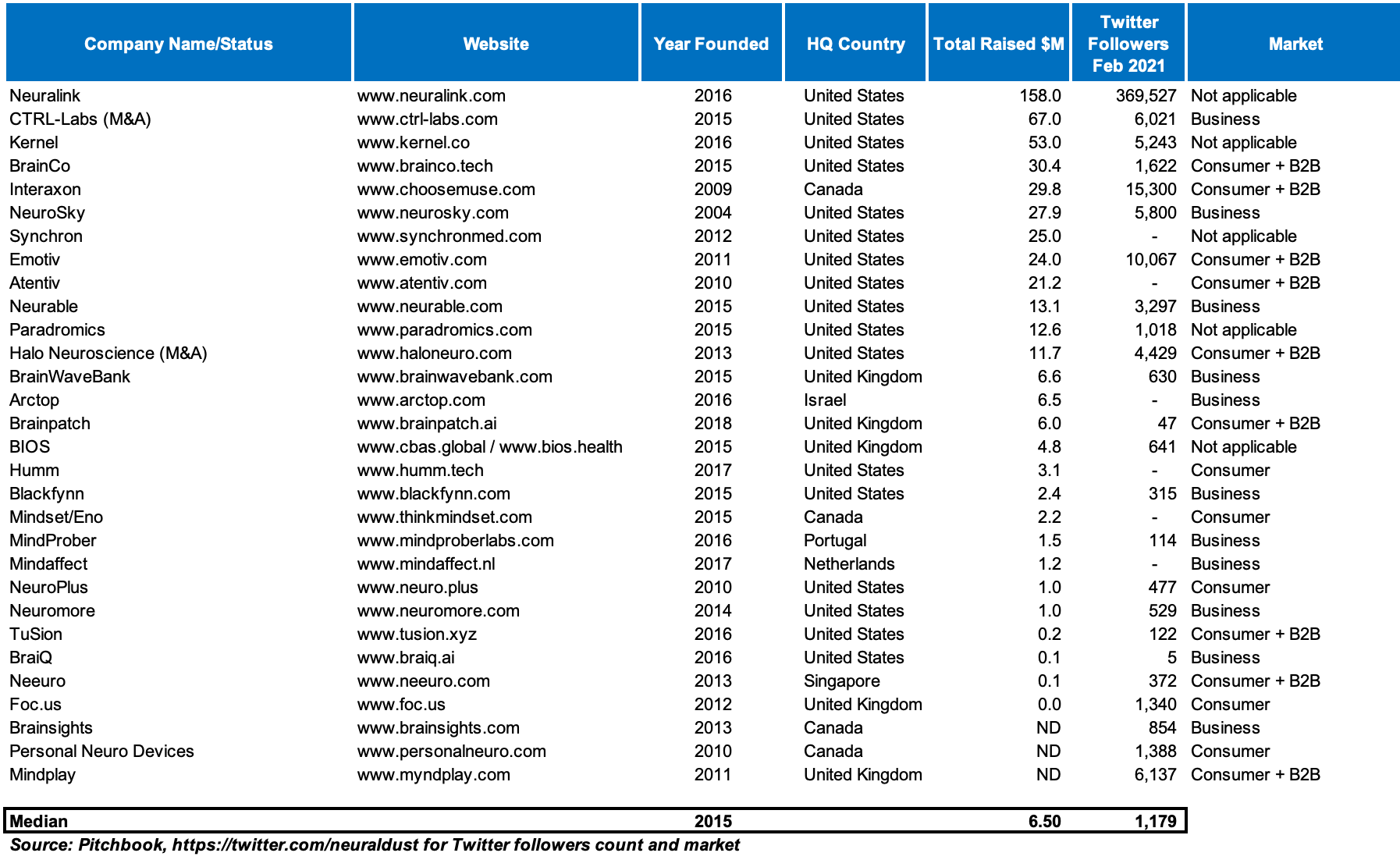

We are living during the formative years of neurotech. 17 out of the 30 studied companies were founded just in 2015 or later. Neurotech also largely did not find its product market fit (PMF) yet. It seems that being research-driven, and frequently hardware, neurotech startups go way beyond 1–2 years that are usually required to achieve the PMF by SaaS/consumer businesses (as per Andrew Chen/Quora discussion). Some indicators of how young neurotech is include:

- early stage fundraising — the median volume of venture capital raised per featured company over its lifetime is $6.5M, far beyond $8.6M, a US-based company median size of an A round alone (chart 2);

- limited following on social media. Median number of Twitter followers for a neurotech company is 1179 (a notable exception is Neuralink). Compare it to following of companies that operate in more mature sectors like mobile, wearables, or VR: Apple — 5.9M, Fitbit — 369K, Oculus — 69K followers respectively;

- fuzzy business models — 30% of reviewed startups serve both, consumers, and businesses. Also, 1/3 of startups operate across multiple layers of the stack, building not only business or consumer applications, but offering dev tools, providing SDKs (chart 1).

Out of 18 startups that offer applications (both for consumers and corporations) 11 are targeting two or more markets, frequently unrelated. For example, provide insights for marketing professionals and offer products for education providers.

Given this early stage, where may non-medical neurotech go from here? I’d expect more emphasis on neurotech apps, both in consumer and business domains, rather than on infrastructure as ‘the history of new technologies shows that apps beget infrastructure, not the other way around’.

We’ve already witnessed multiple tech adoption cycles propelled by consumer applications. Mobile phones, VR headsets, and even graphics processing units (GPUs) that allowed machine learning at scale — all these technologies got a strong boost by consumer applications.

Finding clever applications of neurotech will affect its adoption in two waves. First, high volumes associated with consumer and sometimes business apps will allow us to avoid the situation where a consumer EEG headset with a $100 bill of materials is sold for $300–500, only because of low volumes of orders and the need to cover fixed costs of running a business. Later, when neurotech is adopted at large markets, and prices went down, adoption at smaller/thinner markets will be possible.

It’s hard to tell what consumer application will launch the initial neurotech adoption. For instance, an ability to control virtual/gaming environments (see CTRL-Labs, Brink Bionics) may make neurotech popular among gamers. Meditation, mindfulness, and productivity movements also look like relevant candidates for giving neurotech a boost. Regardless of the exact application, consumer adoption of neurotech seems more probable to me in the midterm, several factors are in its favour:

- Consumer tech giants seem to be interested in neurotech, Facebook acquired CTRL Labs, paying probably more than Google paid for DeepMind, a marquee acquisition that contributed to AI hype and ML/DL adoption;

- These giants have enough cash to sponsor R&D and distribution of headsets that for now limit neurotech adoption. Alternatively, consumer giants are well-positioned to find ways to monetise these headsets, without charging consumers directly, e.g. via other products like AppleHealth or Google Fit, games, or advertising;

- Consumer internet giants are built around network effects. In the most simplistic way network effects ‘…occur when a company’s product or service becomes more valuable as usage increases’, e.g. the more of your friends use a social network, the more useful the network is for you. Neurotech seems to be very well-placed for plugging into these network effects.

Imagine sharing emojis inspired by electrical signals of your brain via your favourite messenger. Or curating playlists in your music subscription app that ideally reflect your mood.

Messaging, sharing, curation, these and other mechanics of consumer platforms could be reinforced by neurotech. And in turn, increase its adoption; - In addition to large consumer tech incumbents, new growing entrants may benefit from a wider adoption of neurotech and are likely to invest there. Meditation apps like Headspace and Calm are growing quickly, with the former already achieving the unicorn status. Fitness startups, like Mirror and Peloton (already a unicorn) bring new types of experiences to the audience. Adding neurotech to this kind of products looks like a relevant option;

- Consumer internet earlier was very responsive towards tech innovations. For example, machine learning became widely known through consumer apps doing style transfer and augmented reality. The first wave of notable acquisitions of ML startups occurred in the consumer internet space, Snapchat acquired Looksery in 2015, FB acquired MSQRD in 2016, to name a few. I’d expect similar dynamics with neurotech.

Business applications of neurotech will definitely emerge as well. Even nowadays there are startups that use EEG sensors for mining marketing insights or helping developers to maintain the flow state. There are factors that limit enterprise neurotech adoption however:

- A wider social acceptance of neurotech is required before it could be implemented in workplaces. Employers could hardly persuade employees to wear EEG headsets, or other tech, and provide the access to deep personal data unless it’s widely accepted;

- Unlike consumers, enterprises have a mature existing tech stack, and bringing any new technologies in will require integration into it. Before neurotech is mature enough (in terms of cyber security, compliance, APIs, etc.) its adoption by enterprises will be limited;

- Product-wise, consumers usually require less features than enterprises. For instance, a corporate messaging app, unlike a consumer one, is more likely to have a more robust search function, collaboration features, more complex permissions control and admin functions, etc.

Therefore I’d expect gradual neurotech adoption by enterprises, supported by growing number of available features, and more rapid adoption by consumers, driven by a ‘killer feature’. Then a build up of the infrastructure follows, with multiple feedback loops between consumer, enterprise, and infrastructure segments.

Consumer adoption is likely to create hype and influx of capital in neurotech startups. That in turn positively affects those who build enterprise neurotech. Also, I’d expect the most successful consumer neurotech companies will be branching out into enterprise and healthcare markets, after gaining some muscles and ability to meet required regulation (that may be extended beyond GDPR).

Feedback loops from enterprise/government tech to consumer tech will also likely happen. We’ve seen some examples of consumers reusing enterprise tech, for example, ‘Slack and Zoom have begun with enterprise-focused products, but these products have been adapted by consumers for their uses, and have even experienced consumer-like viral adoption’. Results of the military R&D will likely spill over into consumer applications. As it was with The US Military’s R&D, that is ‘… responsible for almost all the technology in your iPhone’.

Being locked into these adoption cycles and feedback loops, we all still need to consider that opening access to our brains is more dangerous than opening access to our phones. Therefore, it’s even more important that both startups and incumbents make ‘strong data ethics’ a part of their strategyinstead of turning to the infamous ‘delay, deny, and deflect’ approach.

Subscribe 📩 , follow me on Medium or on 🐦 Twitter for new writing on neurotech and startups, DM/comment for putting your startup on my radar.

***

🙏🙏🙏 Many thanks to Zoe Chambers and Matt Vallin (investors at Octopus Ventures 💰🦄) and Nickolai Vysokov and Dauren Toleukhanov (co-founders at BrainPatch 🧠🔬🎧, mentioned above) for reviewing early drafts of this post.

***

Data collection note

Data on capital raised and companies status is from Pitchbook. Some companies that went out of business are in the list to demonstrate a variety of neurotech applications. This is hardly a complete list of neurotech startups. I’ve included in it those who raise some significant amount of venture capital or/and just happen to be on my radar.

After reviewing this article with the community I’ve received multiple pointers at some fantastic neurotech startups, as well as open source projects. For example, NeuroPype and Rune Labs were mentioned on the infrastructure side of things, and OpenWater on the research side. I’ll include them and others in a wider neurotech map I’m working on.