Neurotechnology landscape: Europe (2021)

An overview of 67 European neurotech startups, industries/markets that they serve, and what layers of the tech stack they operate at

This article was originally posted on Astrocyte (archived).

Tech and investment community becomes increasingly interested in neurotech, partially due to brain-computer interfaces being actively covered by the media. In this article, I explore the current state of the European neurotech landscape and outline opportunities for entrepreneurs.

For this article, neurotechnology is defined ‘… as the assembly of methods and instruments that enable a direct connection of technical components with the nervous system’, therefore not only brain-computer interface (BCI) startups are included, but those who work on brain stimulation, imaging, build an enabling infrastructure, e.g. software for data processing, or surgery robots.

Why now?

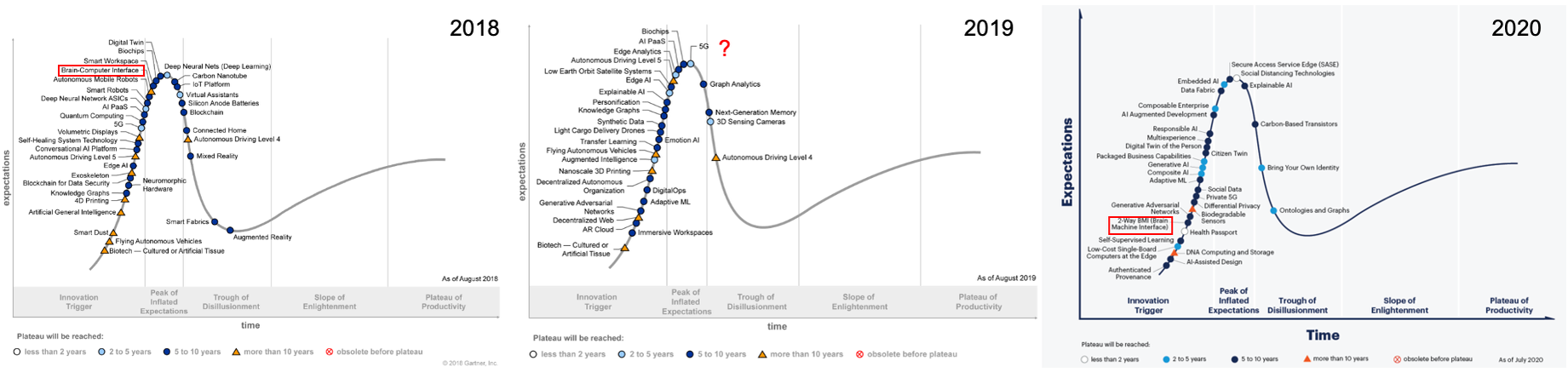

Timing is paramount for both entrepreneurs and investors. However, it’s difficult to make judgments on it. For instance, the famous Gartner Hype Cycle does not demonstrate consistency with brain-computer interface (BCI) tech, see chart 1.

An intuition, however, might be that the BCI tech is approaching the highest point of the curve, and as one of the neurotech entrepreneurs pointed out to me, is spending some extended time there, as the COVID pandemic brought additional attention to mental health issues. The pandemic highlighted mental health challenges, allowing various startups to grow and address them.

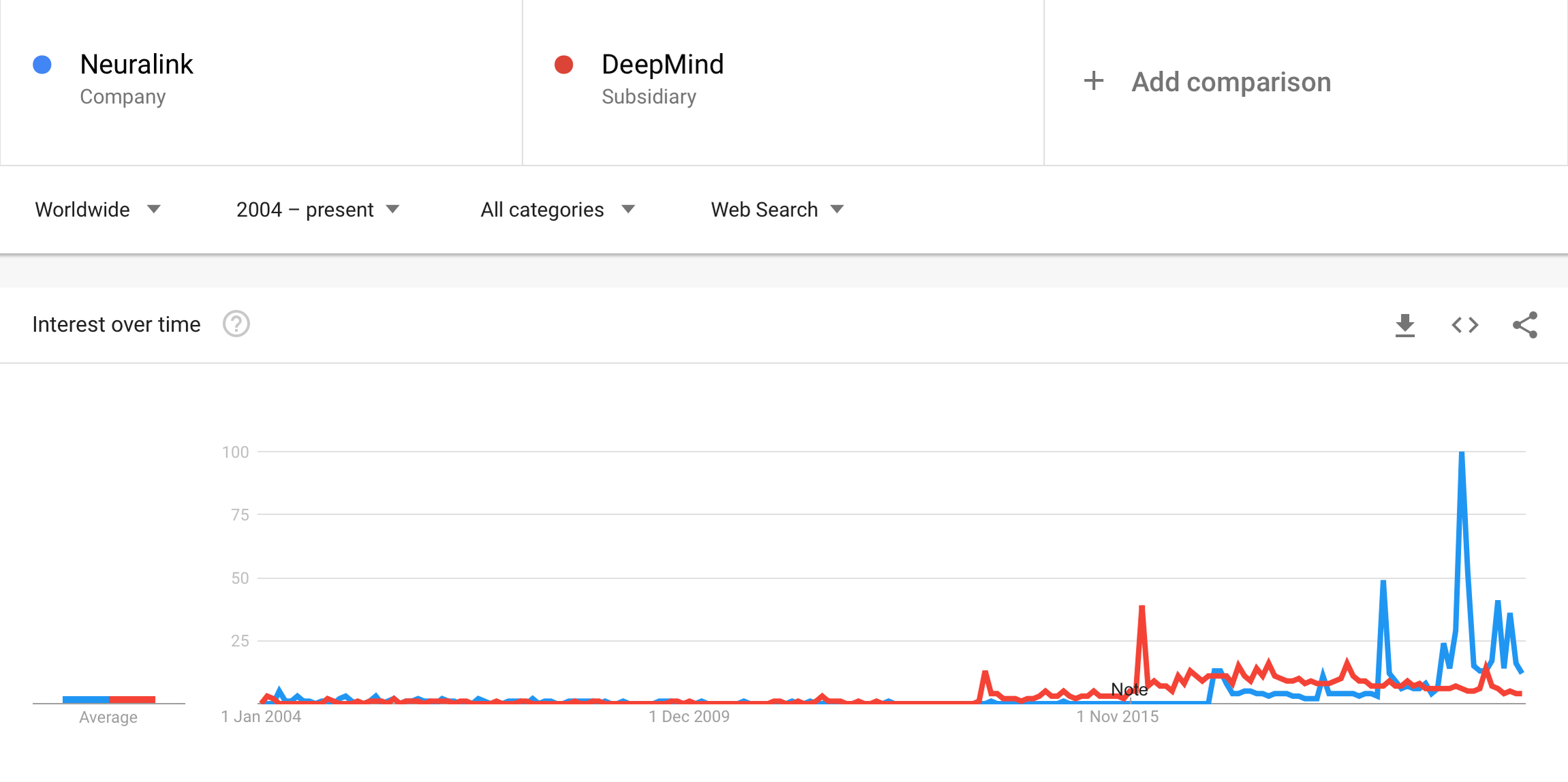

A wider audience became hooked to neurotech during the pandemic. Neuralink’s presentations got millions of views on YouTube, and the company hit another peak on Google Trendsin Aug 2020. Moreover, in 2020 Neuralink continued to grow on Google Trends, unlike DeepMind, the symbol of the AI technology wave (Chart 2).

Attention/hype is not the only factor of why now there’s a good time for launching a neurotech startup. There are positive developments in both industries that create commercial opportunities for neurotech and provide components to it.

The digital health sector had a fantastic year in 2020, twelve companies went public and VCs were eager to invest in startups. Digital health services accelerate the adoption of neurotech as they put in place infrastructure and a business case for therapies that eventually could be delivered to patients’ homes by neurotech startups.

Even though we might not see a technological breakthrough that will propel neurotech in the same way as graphics progressing units (GPUs) propelled deep learning/AI, there are reasons to be optimistic. Increasing investments into the deep tech sector, for example, quantum computing, affect neurotech positively. Quantum-enabled magnetic field sensors that don’t require cryogenics propel magneto-encephalography (MEG). There are more examples of applying quantum computing to biological sciences here.

The proliferation of machine learning is another positive factor for neurotech. For instance, neural networks ‘…provide a new approach for neuroscientists to build models… as well as to explore optimization in neural systems, in ways that traditional models are not designed for’.

Tech giants and the leading investors also started to explore the space actively – CTRL-Labs was acquired by Facebook at the end of 2019 for up to $1B. Kernel, another neurotech startup raised an impressive $53M in 2020 from the likes of General Catalyst and Khosla Ventures. Khosla Ventures made multiple bets in neurotech, investing also in StimSciecne, Thync, and Synchron, to name a few. In 2021 Peter Thiel invested in Blackrock Neurotech.

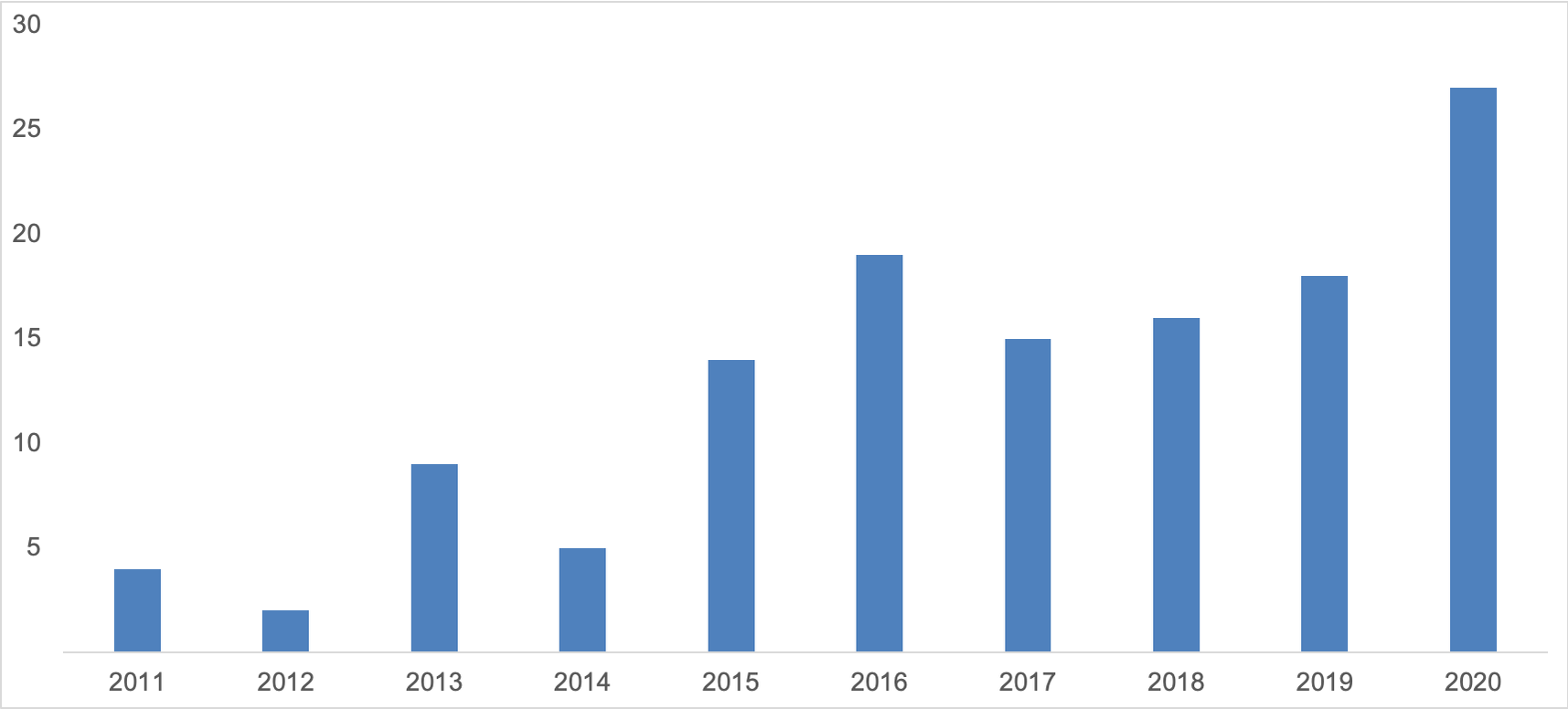

The European neurotech ecosystem is active too. In the last decade, it produced a plethora of companies, capable of competing with the leading US startups. Data from a sample of 67 European neurotech startups suggests that 2020 was a breakthrough year for the ecosystem. 27 unique companies raised capital, up from just four in 2011 (chart 3)*.

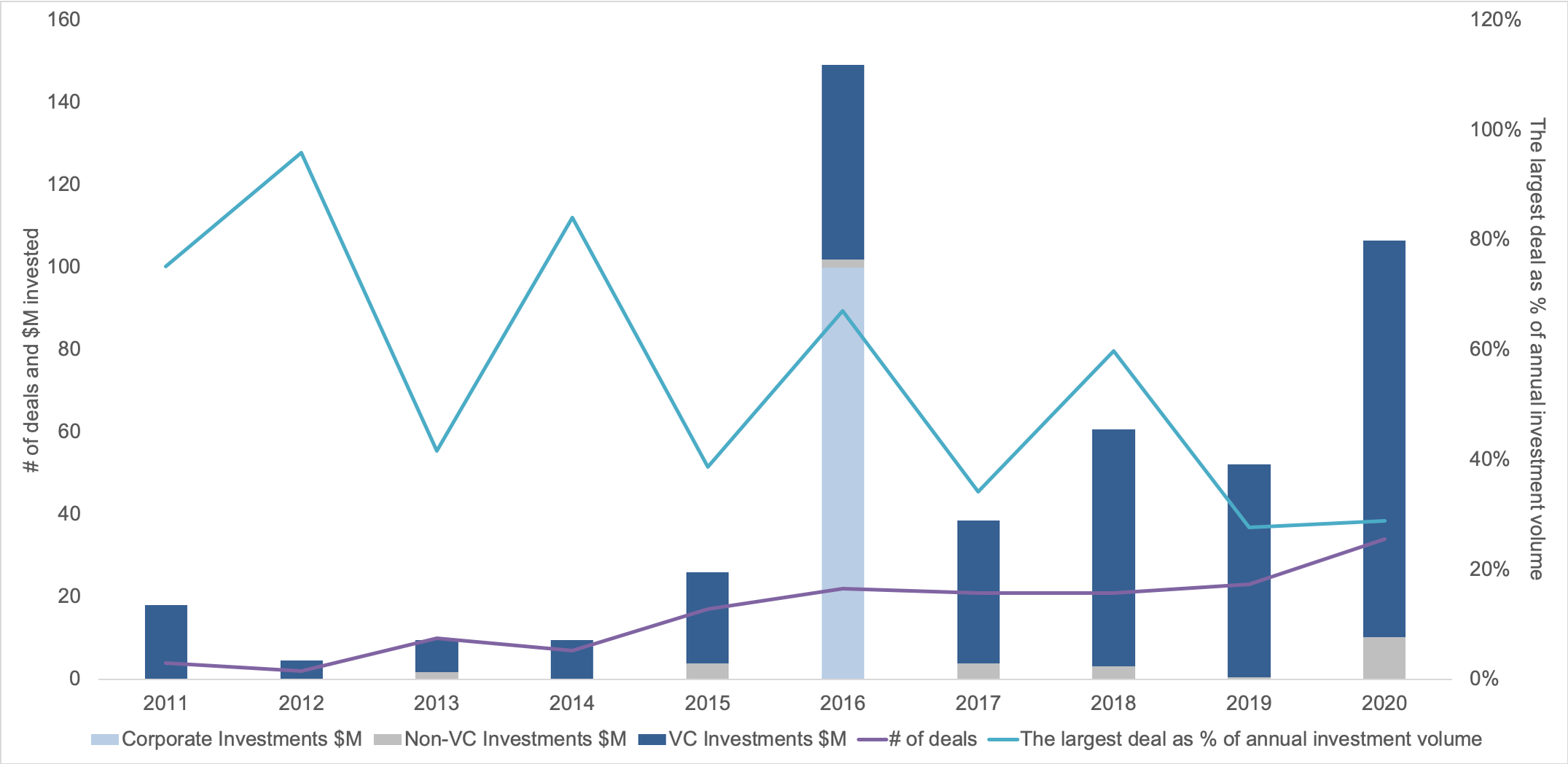

Moreover, even if the volume of capital invested in neurotech in Europe does not form a clear upward trend, the share of mega-deals is falling, and more startups get funding (Chart 4). The share of the largest deal in the annual investment volumes went down from as much as 96% in 2012 to 29% in 2020. The number of deals did also grow during the last decade from just 4 in 2011 to 34 in 2020.

If everything goes well, one may expect that neurotech newcomers will transform into giants of the new industry. The transformation will likely be a challenging one, after spending a year or two at the top of the hype curve, neurotech startups will face the trough of disillusionment/death, and only those who survive it will see the slope of enlightenment.

Current European Landscape

What kind of industry will neurotech be, is a question for now. However, we still could explore how the ecosystem is structured right now and what kind of startups operate there. This article covers 67 mostly venture-backed startups that represent a fair sample of the industry*. You could find a Twitter accounts list that includes 55 out of these 67 startups.

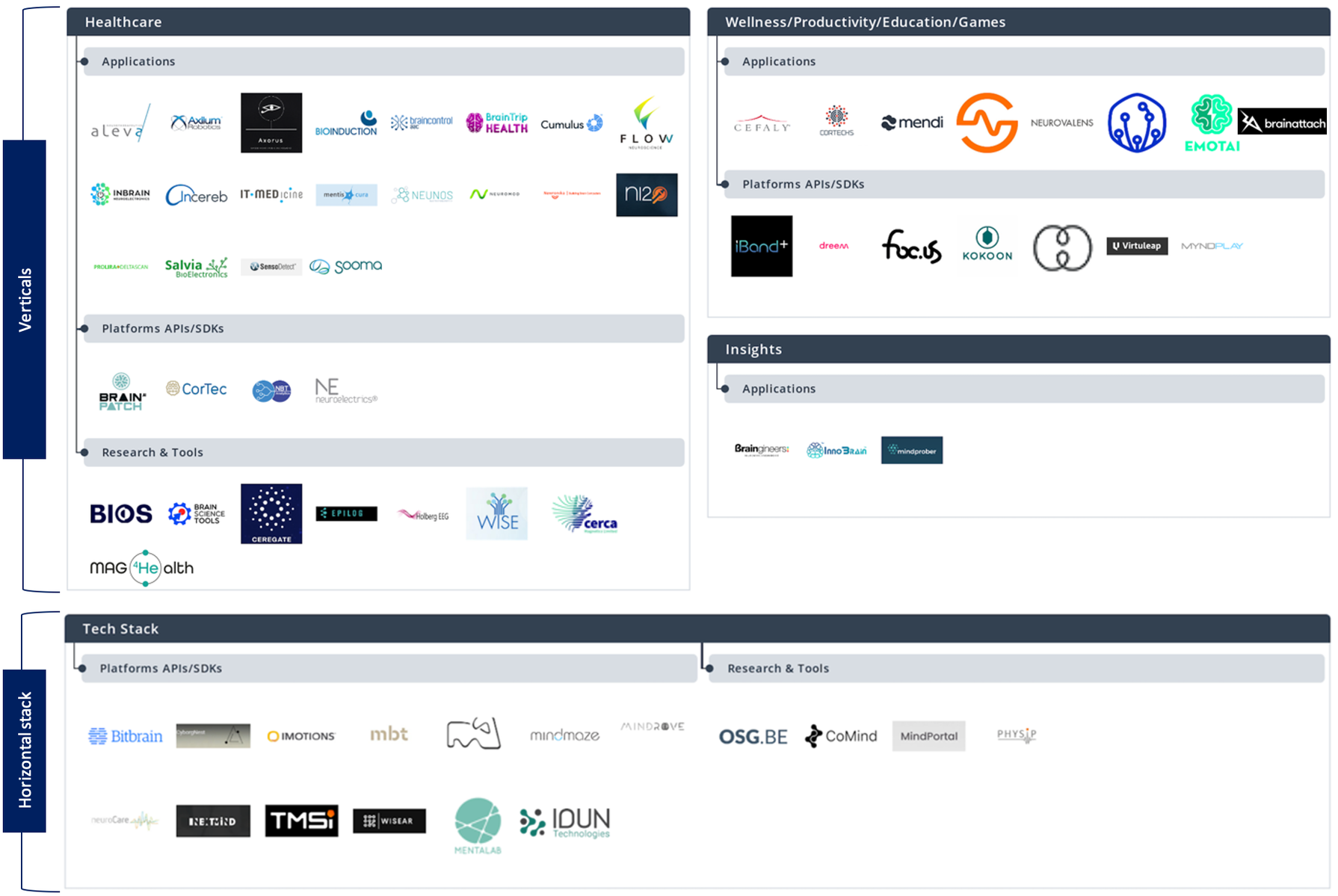

The European neurotech landscape is dominated by startups that develop products within certain industries/functions, most notably in the healthcare segment. 50 out of 67 have a clear industrial specialization.

The remaining seventeen companies are industry-agnostic and built what one may call the ‘tech stack’, a set of tools, APIs/SDKs for other developers/researchers to use. These startups follow the so-called horizontal approach, having no clear industrial specialization, or covering as many industries as possible, (chart 5).

Among 67 selected companies, 32 focus on the healthcare segment. These startups usually work with hospitals, pharmaceutical companies, and other businesses to address neurological diseases. For example, Aleva Neurotherapeutics builds a neurostimulation platform for treating Parkinson’s disease and essential tremors, and CorTec works on an investigational fully implantable system for long-term measurement of neuronal activity and electrical stimulation.

Other applications and industries are much less explored by European neurotech startups. Eighteen companies cover multiple segments, for example, wellness/consumer health, productivity, and education. These startups usually work with consumers or businesses directly, and sometimes offer products to both. For example, PlatoScience offers a consumer device for achieving a flow of concentration and productivity. Braingineers helps enterprises explore what their customers truly experience in an online product, app, web page, or video. Dreem sells a consumer headband for sleep tracking and offers a sleep assessment solution for clinical trials to business customers.

The tech stack is the smallest part of the ecosystem. Seventeen startups offer tech that can be used by other developers across various verticals and functions via APIs/SDKs. They also build research tools. Some startups, like NextMind and Mindrove, offer full-stack platforms for building neurotech apps. Others, like MindAffect or MindMaze, turn to open-source software. This bucket also includes startups that research new approaches to the BCI, or develop research tools.

Startups in the tech stack bucket follow two paths, they either start industry-agnostic from day one, as NextMind did, or like MindMaze start within a certain vertical, e.g. the healthcare to address stroke, Parkinson’s disease, etc., but then endeavor into other areas, like games and even into designing an own chip.

There’s very limited consumer exposure in neurotech, and among selected 67 startups in particular. Only ten startups focus on consumers only, and another twelve work with both consumers and enterprises. Consumer applications mostly tackle wellness and productivity challenges, and gaming sometimes.

Analysis & Reflections

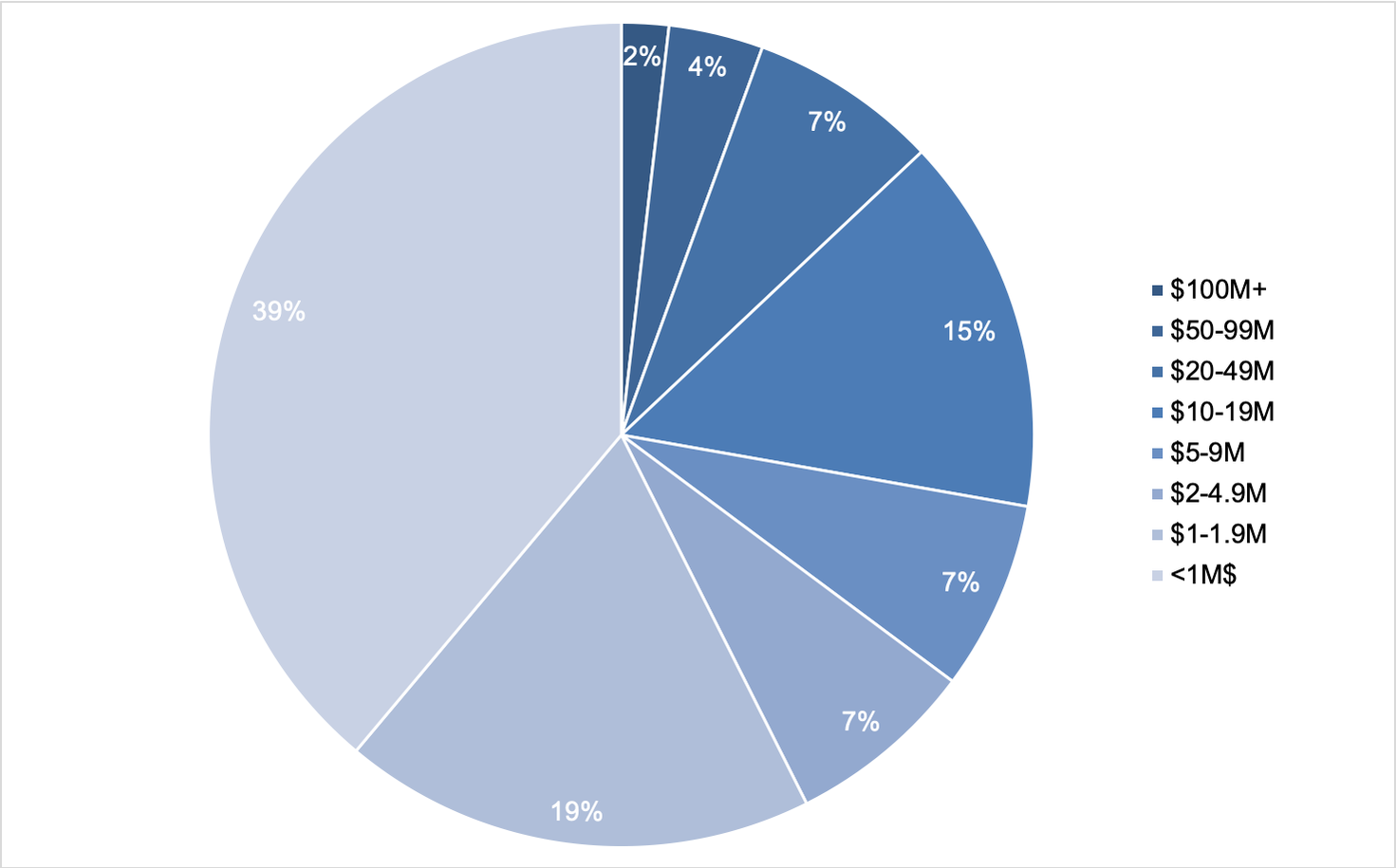

Limited fundraising success. Even if Europe produced some neurotech startups with an impressive fundraising track record (MindMaze, Aleva Neurotherapeutics, Dreem, Salvia BioElectronics, etc.), the majority did not go so far. The median volume of capital raised per a European neurotech company is just $1.8M (that’s smaller than an average seed round in the US). 40% of startups with known fundraising volumes raised less than $1M across their lifetime (Chart 6).

A longer road to product-market fit (PMF). Typically, achieving product-market fit takes between one and two years (see Andrew Chen/Quora discussion). However, it probably takes longer for neurotech startups. Using fundraising data as a proxy for MPF (not the best option though, see VC-market fit) I’d guess that way less than 30% of European neurotech startups achieved PMF. Achieving PMF after raising less than $10M in such a research-intense/regulated and young market seems hardly doable to me.

Several factors might make achieving PMF harder for neurotech startups, among them are:

- A very young market with no playbooks, where there are no successful startups to fill the startup idea matrix in. Therefore, exploring and confirming use cases takes longer;

- Having a hardware component that requires engineering, production, and distribution;

- Strong research/academic DNA is important for building groundbreaking tech. However, sometimes it may make it harder to attract outsiders with marketing, product management, and commercial backgrounds. I’d estimate that European neurotech startups that raised capital in 2020 had almost a 2x larger share of founders with doctorate degrees, compared to teams that worked on AI startups;

- Expanding regulation. Since May 26th, ‘… the medical device legislation is applicable for the first time also for products without an intended medical purpose’. All brain stimulation devices that use tDCS, tACS, tRNS, etc, now must comply with the medical device regulation, and therefore bear the associated costs.

- The growing complexity of clinical trials.

These, and probably other factors, push European neurotech startups towards innovating, for example by improving clinical trials via services from other startups or/and building business models in a way that allows them to sponsor customer development by proceeds from selling to the existing markets (neuroscience research, healthcare, drug discovery). An option of moving to another less-regulated jurisdiction might be a temporary solution since it’s not clear if/when other regulators follow their European counterparts.

Platformization of neurotech. Whether we think about platforms in terms of ‘…providing value by connecting two or more types of customers’, or in terms of having ‘… near-zero marginal cost of access, reproduction, and distribution’ neurotech startups may (and already do) apply the platform approach. For example, Dreem appears to be building a two-sided platform. Neuroelectrics, on the other hand, builds a platform around an SDK, that allows to ‘build research applications interacting directly with [our] hardware… to receive all information in real-time… to facilitate the development of multi-machine or multi-environment applications’.

In total, I’ve counted at least 23 platforms in the sample of 67 startups. Notably, among ten of the most well-funded startups, four (MindMaze, Dreem, CorTec, Neuroelectrics) build platforms in one way or another.

Platfomisation of neurotech might not be as wide as in the tech sector overall, where, according to some estimates, seven out of ten largest tech companies are platforms. We may expect more neurotech platforms after the core consumer and medical applications achieve some scale and create enough demand from application developers. Platformization may take longer, however, since the majority of neurotech startups cater to the healthcare market, where application programming interfaces (APIs) are slower adopted.

Challenges with data acquisition. Working mostly in the healthcare sector, and just slightly touching consumer internet with its virality, neurotech startups struggle to collect data from users. For instance, Bioserenity that operates in the healthcare market has 100Khistorical EEG records. Dreem, which operates in the consumer market, however, monitored 2.1 million nights with its EEG headset. Putting the quality of these records aside, the volume difference is significant.

Scaling data collection, and integrating it into business models is also much harder from the regulatory and ethical perspectives.

Unclear exit perspectives beyond healthcare. For example, in the AI market, tech giants (Apple, FB, Google, etc.) were responsible for 30-50% of acquisitions, depending on a timeframe. In European neurotech, however, startups were mostly snapped up by medtech companies, for example, Incereb was acquired by Lifelines Neuro, OSG went to Micromed, and Sapiens Steering Brain Stimulation found a new home at Medtronic. Therefore, even if the first notable neurotech acquisition by a consumer internet company already took place (Facebook and CTRL-Labs), it’s not yet clear who will become a driving force behind eventual industry consolidation.

Opportunities

No data monopoly. Neurotech startups do not face data monopolies as do startups that operate on some other markets. Unlike AI powerhouses (Google, Amazon, Facebook, etc.) neurotech incumbents don’t have such advantages as large amounts of data. For example, it’s estimated that 208,000 deep brain stimulation devices were implanted worldwide. These devices were supplied by multiple vendors and were not built for remote access, much less for data collection. Abbot, one of the largest DBS device vendors, just recently got FDA approval for remote programming of devices. Therefore, incumbents on the DBS market pose a lesser threat to neurotech startups than Google or Tesla threaten to startups that operate in the advertising and automotive sector respectively.

Finding the right applications is probably the biggest challenge and opportunity for neurotech startups, mentioned to me by several startup founders. Limited by the existing hardware, and mental models of entrepreneurs and investors, this opportunity requires coordinated efforts to be fulfilled.

Progress at the hardware level alone will not suffice if entrepreneurs will not bring fresh ideas, and investors will not back them. Both entrepreneurs and investors need to be open-minded about which industries may favor neurotech, and spend more time exploring problems and needs of a wide range of industries. Then we might come up with solutions for some unexpected users, like the automotive industry, served by InnoBrain, for instance. While discussing this article, an entrepreneur suggested to me to frame his company in terms of the media industry, rather than in terms of neurotech, that they ‘just happen to use’. That is an approach I’d suggest using a bit more frequently.

Consumer market. Consumer internet was a hotbed for almost all recent technologies, mobile phones, and AI alike. Major consumer internet companies, e.g. Facebook and Snapwork on the next generation of platforms in augmented and virtual realities. AirPods brought more revenues to Apple than NVIDIA made from selling computer chips. Given that building neurotech for VR appears to be on Facebook’s agenda, and AirPods may become a healthcare platform, the consumer internet is a great space for neurotech. Brainattach and EMOTAI, for example, apply neurotech to gaming, while Wisear and IDUN Technologies bring neurotech closer to consumers via earpieces.

Personalisation. Personalisation is a major feature of modern tech, bringing it to neurotech might be a good idea. More startups aim to build systems that could read, and accordingly stimulate the brain, instead of using pre-programmed protocols. For example, Platoscience, Inbrain Necuroelectronis, ni2o, and BrainPatch all consider a closed-loop approach and were founded the last five years.

More modalities. Electroencephalography (EEG) is the modality of choice for the majority of startups, at least 36 companies out of 67 rely on it. However, alternative modalities are starting to receive more attention. Functional ultrasound (fUS) and functional near-infrared spectroscopy (fNIRS) are examples of modalities that researchers pay more attention to. Butterfly Network set an example of bringing a portable ultrasound product for 20 clinical applications. Applying ultrasound to BCIs might follow soon. Neurotech entrepreneurs also explore additional modalities, e.g. magnetoencephalography (MEG) is a tech used by Cerca Magnetics and Mag4Health.

Data science. There is an endless list of data science applications in neurotech. Some startups apply it to interpret neural signals, exercise control over devices and even provoke memories. At a more technical level, there are opportunities in building solutions dedicated to neurotech, for example, classification methods dedicated to the specificities of EEG headsets. There is also an opportunity in applying data science to new modalities and associated datasets.

Regulation as an opportunity. As mentioned earlier, expanding regulation and increasing complexity of associated processes e.g. clinical trials, make achieving product-market fit harder. However, in the longer term, it may have a positive impact on the market. For example, the post-market clinical follow-up process may encourage startups to come up with products based on subscription/recurring revenue models that cover costs of continuous data collection, and also are loved by investors. An attempt to create a new database of medical devices available in the European Union (EUDAMED) with publicly available information on products and tests may lay foundations for the creation of a ‘neurotech app store’.

The ramp-up in both the scale and quality of data necessary to achieve and maintain conformity opens a new opportunity for building competitive advantages/moats. A winning neurotech startup will need not only to create the best product but to build a scalable and efficient infrastructure to support it. For example, Google grew from 112 servers to a $5B-plus quarterly data center bill, mastering not only consumer and enterprise products (search/advertising) but huge infrastructure underlining it.

The need to back claims of acceptable equivalence by a contractual relationship with an equivalent device manufacturer may slow innovations since incumbents will not be motivated to enter into relationships of this sort. On the other hand, the same requirement allows neurotech startups to have an additional layer of defensibility against larger tech companies, who use their data and resources in anticompetitive ways.

Open-source. European neurotech developers may draw on examples of startups that build critically important/infrastructural products in other segments to understand the OSSmodel. For instance, in the database segment, open source is already more popular than commercial license. The OSS might be a good match for neurotech for at least two reasons:

- It allows technologies and products to outlive the company that developed them, and to avoid a situation where a BCI has to be taken out from a user when its developer goes bust;

- The community may help to discover new applications and grow revenues faster.

Overall, open-source or not, I keep a positive outlook at European neurotech. I’d say that success depends on the availability of capital and the ability to attract a diverse pool of talent that is required to supplement the research and domain expertise of startup founders and to build data infrastructure, consumer products, etc.

I’ll continue to follow neurotech and hopefully will be able to highlight more opportunities. Do not hesitate to reach out if you want to talk about your project/startup or simply bounce back some ideas.

📬📬📬 Subscribe at Substack for a monthly newsletter and updates on the neurotech landscape. Follow me on Twitter 🐦🐦🐦.

***

Many thanks to: Ana Maiques, co-founder of Neuroelectrics; Balder Onarheim, co-founder of PlatoScience; Daniel Mansson, co-founder of Flow Neuroscience; Ivo de la Rive Box, co-founder of MindAffect; Jason Farquhar, head of machine learning at MindAffect; Maciej Rudziński, founder of BrainAttach; Mohammad Davari, co-founder of InnoBrain; Pedro R. Almeida, co-founder of MindProber for sharing ideas and views on neurotech. 🙏🙏🙏

***

Appendix

Competing Interest Statement - Peter is a minority shareholder of a non-invasive neurotech company, included in the landscape on Chart 5, but not mentioned in the article. This statement will be updated after the company makes an announcement.

Twitter list to follow updates from these startups.

* Data collection note. Data is for a sample of 67 European neurotech companies. The sample includes companies that raised venture capital (from angels, accelerators, VCs, corporations), some university spin-outs, and non-VC-funded companies that are on my radar. The list includes currently private, as well as acquired/exited companies. It’s not an exhaustive list, however, I’ve done my best to cover those companies that demonstrated signs of going beyond an ideation/pet project stage, i.e. they employ someone other than founders, raise external funding, generate revenues, etc.

Two startups whose HQs are in the US were included due to their European roots – ni2o, and MindPortal.

The sample hopefully fairly represents European neurotech, it’s one of the largest samples. For instance, a 2014-2019 BCI report by Tracxn covered $218M invested in European BCIs. This article, among other things, covers this period but includes deals of $335M.

Startups are classified as follows:

- Applications – startups that build products for end-users (consumers or businesses). Usually, specialise in a certain industry/function;

- Platforms APIs/SDKs – startups that build products for end-users (consumers or businesses) and add APIs/SDKs to these products, e.g. to connect data with other applications, or to allow developers to use it;

- Research & Tools – products that are mostly used by neuroscience researchers, neurosurgeons, and developers, but don’t have APIs/SDKs. Also, includes companies that are engaged in research and yet to productise it.

Also, all companies are aligned around specific industries/functions (healthcare, insights, wellness & others) and infrastructure, which is industry agnostic, and in a sense is ‘horizontal’.

** The number of startups on the chart is different from the sample as the data on the exact fundraising year is not available for all sampled startups.