Why established tech hubs are still the best place for early-stage startups

Product talent pool and potential customers - guiding principles on where early-stage deep tech startup founders should relocate

Tech entrepreneurship became a truly global phenomenon. Europe, in particular, made significant progress in growing its tech ecosystem – there is hardly a European country that has not produced at least one unicorn. Emerging European tech hubs are ramping up their efforts to attract new citizens. However, I believe that established tech ecosystems are still the best choice for launching or relocating a pre-product-market fit (PMF) startup.

Relocating is hard, and it might be very tempting to accept the appeal of emerging hubs with their ‘lenient’ tax systems and ‘affordable living environment’ in an attempt to push costs down. Nevertheless, saving on taxes, or supporting your pre-startup lifestyle are not the variables to maximise during the formative years of your journey.

It is well-known that the US is an entrepreneurial magnet despite all associated costs, taxation, and immigration issues. However, what is less obvious is that these costs are accepted by entrepreneurs who move to the US from countries with better taxes, more affordable health care, and sometimes better institutions. Counterintuitively, despite all downsides, the US can attract not only founders who are escaping failed states or less fortunate tech ecosystems but those who have strong home bases and opportunity costs associated with leaving them.

Out of 70 immigrant founders who launched 50 US unicorns, 43 founders came from other developed countries, for example, nine founders left Israel, and nine came from Canada. France and Germany also contributed their fair share.

These examples demonstrate that there are more important things than low taxes and a nice lifestyle. A potential co-founder, an early employee, or a consultant with proper expertise makes a huge difference for a pre-PMF startup. By relocating to an established ecosystem, a founding team, especially with an engineering background, usually finds what that type of team needs – product and commercial talent.

Developed ecosystems, for example, offer a much wider pool of product talent compared to emerging hubs. These hubs are simply smaller. Moreover, the leading companies operating out of emerging hubs keep their product management function in these hubs to a smaller extent (chart 1). To illustrate this point, let’s query LinkedIn. For instance, Google alone has four thousand product employees (or 73% of its product management function) in the US, Revolut keeps 81 employees (or 69% of the function) in London. However, Wise, the most famous fintech startup from Estonia, keeps only 20 staffers, or 22% of its product function, in Estonia, an emerging hub. Therefore, early-stage startups risk finding a limited supply of product talent at emerging ecosystems.

Chart 1. Product management function by locations, selected startups. Data - LinkedIn

Another distinctive feature of the developed startup hubs is an abundance of enterprises and scale-ups that could purchase new products from early-stage startups and even help design them. For instance, the US scale-ups, which are likely to become early customers for younger startups, usually expand to developed European ecosystems, like the UK, Germany, France, or huge markets like India or Japan. The lack of these early customers and design partners in emerging ecosystems will not make your life easier.

Challenges with the product/commercial talent and early traction might make a journey to the PMF longer. That, in turn, manifests itself via a slower valuation growth.

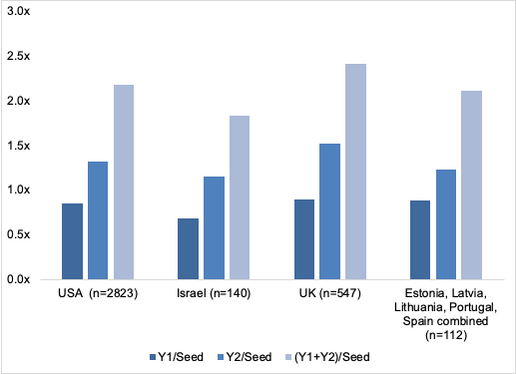

The rate of follow-on fundraising itself, based on my rough estimates, is pretty much the same in London, the European tech capital, and across emerging ecosystems of Portugal, Estonia, and others (chart 2).

Chart 2. Capital raised by startup cohorts at the Year 1 and Year 2 compared with initial Seed rounds at the Year 0 (2019). Data - PitchBook

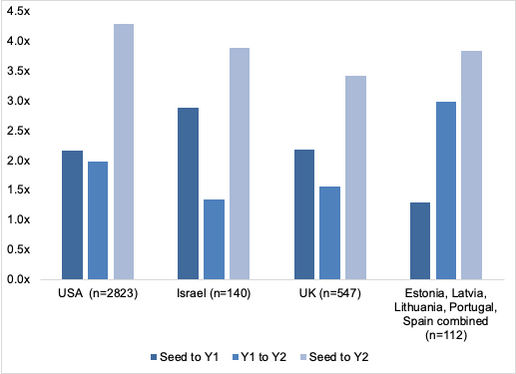

Valuation patterns are, however, very different between established and emerging hubs. It takes one additional year for an emerging ecosystem startup to achieve 3x+ valuation growth to its seed round, compared to a startup from an established ecosystem (chart 3).

Chart 3. Median pre-money valuation growth by startup cohorts between Seed rounds in 2019 (Y0) and subsequent years. Data - PitchBook

In a sense, emerging tech hubs right now are slower versions of their developed counterparts. Don’t get me wrong, as someone who promoted Moscow, I have a thing for developing ecosystems. In some circumstances, they could be the best places to build your company. For example, for an open-source software startup that does product development by engaging with the global community on GitHub, or for an experienced commercial team that needs to find engineering talent, emerging hubs may work. However, most pre-PMF startups, especially led by founders with technical backgrounds, will likely find a better home at the top ecosystems.

I’ll continue to explore the pre-PMF stages of building a startup. To get new articles - follow me on Twitter 🐦

***

Data collection note

LinkedIn data as of August 23rd 2021. Data on capital invested and median pre-money valuation is from PitchBook as of August 15th 2021. Search query - Deal Types: All Series, All VCStages, All Round Numbers; Deal Status: Completed; Location: Search HQ Only. Developing ecosystems are combined together in order to increase the sample size. I recognise, though, that they are very different.